With Itai Ater and Tzachi Raz

The following is a modified version of a chapter from our paper on the economic consequences of the proposed judicial overhaul in Israel, also published as “The Short-Run Impact of the Judicial Overhaul on Israeli Financial Assets“, in Assaf Razin (ed.), The Transition to Illiberal Democracy: Economic Drivers and Consequences, CEPR Press (2024), Ch. 3.

The plan for a judicial overhaul in Israel, announced on January 4, 2023, sent shock waves through Israeli financial markets. In this paper, we document two important, substantial, and relatively easy-to-identify effects that are plausibly attributed to the judicial overhaul: currency depreciation and underperformance of the stock exchange. Identification of the magnitude of these effects is enabled by particular features of Israeli financial markets, namely their domination by a small number of major players (the “institutionals”) and their close dependence on American financial markets. In particular, we show that the S&P 500 index can be used to derive precise predictions of both the NIS/USD exchange rate and the leading indices of the Tel Aviv Stock Exchange, thereby forming a counterfactual against which the effects of unusual local events can be assessed. This simple methodology yields estimates of a 20% excess depreciation of the Israeli currency, as well as a 25% loss in the value of Israeli stocks. While we interpret these effects as ominous symptoms of a future ailing economy rather than a reflection of a current economic crisis, the implied loss of wealth amounts to hundreds of billions of NIS—a devastating blow to the welfare of Israeli households that has already materialized.

Excess currency depreciation

To estimate the extent of excess depreciation of the NIS against the USD since the judicial overhaul was announced in January 2023, we rely on the strong short-run correlation between the S&P 500 index and the USD/NIS exchange rate. Over the past ten years, the opening of Israeli forex-neutralized funds—those that invest in foreign indices and hedge this investment against volatility in the USD/NIS exchange rate—has become increasingly important. To hedge their exposure to foreign capital markets—foremost the American market, and above all the S&P 500—these funds must make large-scale purchases of NIS whenever foreign indices rise and, conversely, sell NIS when they fall. This phenomenon, coupled with the growing amounts of capital that these funds manage, has created a very strong negative short-run correlation between the S&P 500 and the USD/NIS exchange rate (Ben Zeev and Nathan, 2024). Thus, the correlation between the index and the USD/NIS exchange rate is sufficiently strong in the short run that it can be used to identify, with a high degree of certainty, aberrant NIS depreciation or appreciation events. It follows that we can employ this relationship to estimate the extent of excess depreciation of the NIS against the USD since the judicial overhaul was announced.

This figure plots the USD/NIS exchange rate against the S&P 500 index on each day during 2022-3. The first day of each month in 2023 is labeled. The dashed line represents the predicted exchange rate based on a log-linear regression on 2022 data.

To substantiate the strength of this statistical relationship, we focus on the period from January 2022 to September 2023 (Figure 1). Until the beginning of 2023, the USD/NIS exchange rate closely tracked a downward-sloping curve relative to the S&P 500 index. Based on 2022 data, the standard deviation of the daily residuals from the predicted exchange rate was only 1.3 log points (!), equivalent to about 4.5 agorot (0.045 NIS). In other words, conditional on the S&P 500, one could predict the USD/NIS rate with an error of no more than 8 agorot on around 90 percent of days, with hardly any day exhibiting an error larger than 10 agorot. To fix ideas, in January 2023 one dollar was equal to about 3.30 NIS.

As can also be seen in Figure 1, the tight curve that had prevailed since early 2022 was breached outward in late January 2023, coinciding with the stepwise increase in concern about the economic risks associated with the judicial overhaul. In particular, it was in the last week of January 2023 that the former governors of the Bank of Israel issued their warning, and hundreds of economists in Israeli academia and dozens of former directors general of economy-related government ministries signed the “Economists’ Letter.” Such a deviation from the curve is highly uncommon, and we are unaware of any evident reason for it to have occurred at that time other than the turmoil surrounding the judicial overhaul. In fact, over the past five years, such breaches occurred only twice, and for obvious reasons in both cases: first, for only two days at the peak of uncertainty surrounding the outbreak of the COVID-19 pandemic (March 17–18, 2020), and again when the Bank of Israel revised its policy on purchasing foreign currency (January 2021). Thus, the depreciation in early 2023 was unusual and rapid relative to the longstanding pattern.

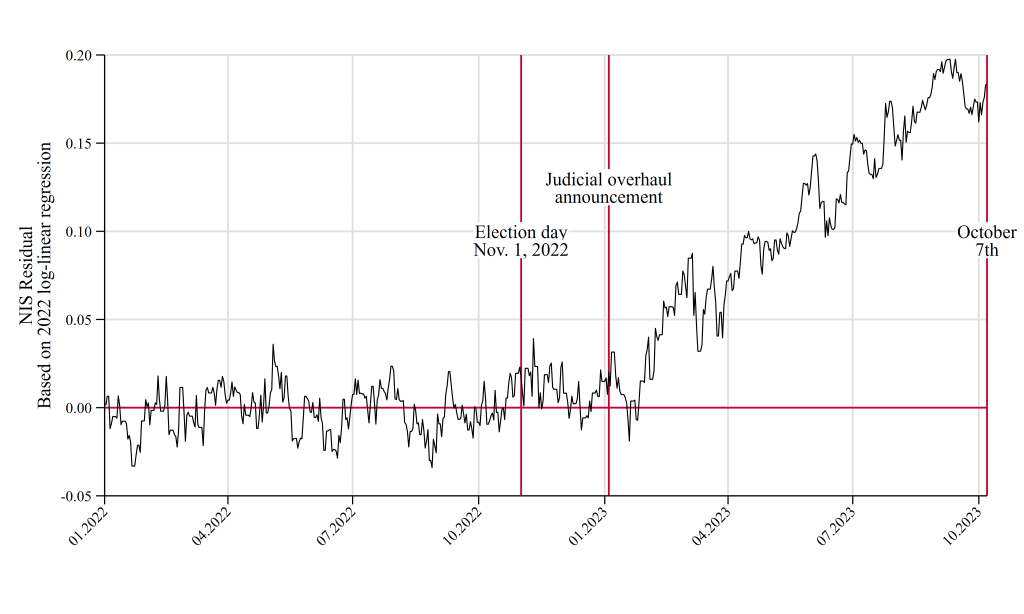

Excess depreciation is the difference between the USD/NIS exchange rate and its predicted value based on log-linear regression on 2022 data, as a ratio of the predicted exchange rate. For example, on Sept. 8, 2023, the actual exchange rate was 3.842 whereas the predicted exchange rate was 3.209, and therefore excess depreciation was (3.842-3.209)/3.209 = 0.197.

The “errors” relative to the forecasts, based on the regression coefficients for 2022, are plotted over time in Figure 2. Until the end of January 2023, the absolute value of excess depreciation was almost always smaller than 2 percent. Since then, however, excess depreciation has been rising persistently, reaching 20% by early September 2023; by that time, the predicted USD/NIS exchange hovered around 3.19–3.23, while the actual rate was more than 60 Agorot higher (NIS 3.80–NIS 3.85).

Yields spread in the equity market

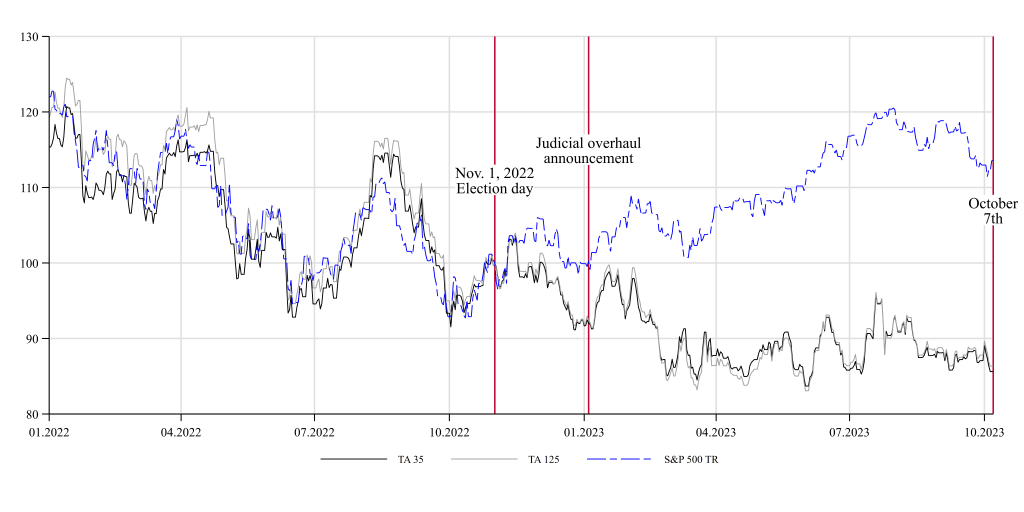

The performance of the Israeli stock market provides yet another perspective on Israel’s capital outflow. As in the case of excess depreciation of the NIS, we use the strong short-run correlation between American and Israeli stock indices to detect excess negative returns of Israeli stocks. Figure 3 juxtaposes the time trend of the S&P 500 with those of the TA 35 and TA 125—the latter two converted into USD terms and all indices normalized to 100 on the most recent Election Day (November 1, 2022). Up to the end of 2022, the Tel Aviv indices tracked the American index with remarkable exactitude, with only a few deviations and no drift. In fact, this near-perfect pre-trend allows us to hypothesize that, absent shocks, the Israeli indices would have continued along the same path (in other words, there was no “pre-trend” prior to the event). Shortly after Election Day, however, the trends decoupled, with the Tel Aviv indices branching away from the S&P 500 with remarkable vigor. By October 2023, the TA indices were underperforming by 20–27 percent relative to the comparison index, which, as we speculate, approximates the counterfactual scenario absent the political shocks (a 12–14 percent loss of value in USD terms, as against a 15–18 percent increase in the American index). The underperformance could be decomposed to the slump in Israeli equity prices, in NIS terms, and the currency depreciation that occurred. In other words, an investor who purchased Israeli stocks on Election Day would, by October 2023, hold assets worth no more than 75 percent of those held by an investor who invested the same sum in American stocks on the same day.

The values of the TA 125 and TA 35 indices and the American S&P 500 index are normalized to 100 on Election Day (November 1, 2022). The three indices trended almost identically until Election Day; afterwards, the Israeli indices and the American index parted ways. The spread widened steadily until the end of the sample period in early October 2023.

Concluding thoughts

In this short paper, we document two large changes in the value of Israeli financial assets. We attribute these changes to the judicial overhaul advanced by the new government starting in January 2023. Our interpretation is that these changes stem mainly from expectations of long-run damage to the Israeli economy. In other words, the judicial overhaul lowered investors’ expectations regarding the performance of the Israeli economy in the medium and long run.

That said, at the time of writing, the coalition’s ability to realize its schemes fully seems unlikely. If so, might some of the short-run damage already sustained be repaired? And might the long-run damage be avoided? On the one hand, there is reason to fear that the answer to both questions is negative. The sweeping move to pass the judicial overhaul into law without attempting to anchor it in broad consent broke the unwritten rules of the political system—those that define how comprehensive changes of this kind should take place. Therefore, even if a short-run compromise is found, there is reason to fear that future political alignments will again attempt to implement a similar reform and, this time, perhaps succeed. Accordingly, when foreign investors consider whether to place their money at long-run risk and tether its fate to that of the Israeli economy, they will take into account the possibility of material and fundamental change in the business environment and the statutory framework in which they operate.

On the other hand, the events of the past few months have demonstrated the strength of Israel’s civil society and its willingness to mobilize in defense of democratic values and, through them, to bolster its long-term economic outlook. Insofar as this civic strength persists and even grows, it may be possible to assume—cautiously—that some of the damage already inflicted on the Israeli economy can be reversed.

Addendum: Events since Oct. 7

Excess returns of the Tel Aviv indices relative to S&P500 (true returns), normalized to Election Day (Nov. 1, 2022), where 100 = equal returns.

Since October 7, excess returns on the Tel Aviv Stock Exchange have largely tracked geopolitical developments. In the immediate aftermath of the attack, the TA indices suffered an additional blow, reducing excess returns since Election Day to more than 30 percent negative. As the war protracted without a clear solution to Israel’s new security conundrum, the indices largely remained at that level, with no clear upward or downward trend, for the next eleven months. In the wake of the pager operation in Lebanon and the subsequent collapse of the Assad regime in Syria, the stalemate was broken and Israel’s strategic situation began to improve precipitously. This shift was mirrored by a steady relative appreciation of the TA indices, which lasted almost continuously through the Twelve Days War against Iran and the temporary resolution of the active conflict in Gaza in June and October 2025. By the end of 2025, the TA indices had more than compensated for their depreciation during 2023.

As the period of analysis extends, the “parallel trends” assumption becomes harder to defend. Many intervening events may have affected the relative performance of Israeli stocks, both domestically and abroad. Yet, taken at face value, the naïve interpretation is that the damage from the judicial overhaul and the outbreak of the war was undone by the cessation of hostilities and the unexpected improvement in Israel’s geopolitical standing, and perhaps also by the inability of the current ruling coalition to fully implement its judicial overhaul program. Moreover, according to all reliable polls, the judicial overhaul is widely unpopular, and Netanyahu’s coalition is unlikely to form the next government in the upcoming elections, which will take place no later than late 2026. Although this may not eliminate the prospect of a renewed institutional onslaught in the more distant future, it may nonetheless provide meaningful relief.

Leave a comment